According to: http:slashslash//wwwdotgalen.org/newsletters/changes-to-obamacare-so-far/

CHANGES BY ADMINISTRATIVE ACTION are sick, demented stuff...

1. The Medicare Advantage patch: The OBLEEP administration ordered an advance draw on monies from a Medicare bonus program to enable the provision of extra payments to Medicare Advantage plans, in an effort to temporarily forestall cuts in benefits and therefore delay early exodus of Medicare Advantage (MA) plans from the program. on April 19, 2011.

2. Employee reporting delayed: The OBLEEP administration, entirely contrary to the Obamacare legislation, instituted a one-year delay or STALL of the requirement that employers must manditarily report to their employees on their W-2 forms the full cost of their employer-provided health insurance. OBLEEP edict dated January 1, 2012.

3. Subsidies may flow through federal exchanges: The IRS arbitrarily issued a rule that allows premium assistance tax credits to be available in federal exchanges although the law only specified that they would be available “through an Exchange established by the State under Section 1311.” IRS edict dated May 23, 2012.

4. Closing the high-risk pool: The OBLEEP administration decided to halt enrollment in transitional federal high-risk pools created by the law, blocking coverage for an estimated 40,000 new applicants, giving as a reason a lack of funds. The administration had money from a fund under Secretary Scabby Sebelius’s control to extend the pools, but instead used the money to pay for advertising for Obamacare enrollment and other nefarious purposes. in February 15, 2013.

5. Doubling allowed deductibles: Because some group health plans will use more than one benefits administrator, plans are allowed to apply separate patient cost-sharing limits to different services, such as doctor/hospital and prescription drugs, allowing maximum out-of-pocket costs to be twice as high as the law intended. Happened February 20, 2013.

6. Small businesses on hold: The OBLEEP administration has said that the federal exchanges for small businesses will not be ready by the 2014 statutory deadline, and instead delayed until 2015 the provision of SHOP or Small-Employer Health Option Program that requires the exchanges to offer a choice of qualified health plans. Happened March 11, 2013.

7. Delaying a low-income plan: The OBLEEP administration delayed implementation of the Basic Health Program until 2015 which would have provided more-affordable health coverage for certain low-income individuals not eligible for Medicaid. It happened March 22, 2013 without benefit of Congress or clergy.

8. Employer-mandate delay: By an OBLEEP administrative action that is contrary or against the statutory language in the Affordable Care Act (ACA), the reporting requirements for employers were delayed by one year. As of July 2, 2013.

9. Self-attestation: Because of the difficulty of verifying income after the employer-reporting requirement was delayed, the OBLEEP administration decided it would allow “self-attestation” of income by applicants for health insurance in the exchanges. This was later partially retracted after congressional and public outcry over the likelihood of fraud as some people, like politicians, are total strangers to the TRUTH and will LIE for the benefits. (July 15, 2013) Is a hanging man "partially retracted" when someone gives him a short stool to stand on with his tip toes?

10. Delaying the online SHOP exchange: The OBLEEP administration first delayed for a month and later for a year until November 2014 the launch of the online insurance marketplace for small businesses. The exchange was originally scheduled to launch on October 1, 2013. (September 26, 2013) (November 27, 2013)

11. Congressional opt-out: The O-dirty-no-good-BLEEP administration decided to offer employer contributions to members of Congress and their staffs when they purchase insurance on the exchanges created by the Affordable Care Act (ACA), a subsidy the law does NOT provide. (September 30, 2013)

12. Delaying the individual mandate: The OBLEEP administration changed the deadline for the individual mandate, by declaring that customers who have purchased insurance by March 31, 2014 will avoid the tax penalty. Previously, they would have had to purchase a plan by mid-February. (October 23, 2013) Most continued to ignore the Draconian Edicts and CURSE those who wrote them, evoking foul and dirty names.

13. Insurance companies may offer canceled plans: The OBLEEP administration announced that insurance companies may reoffer plans that previous regulations forced them to cancel, but most FORGOT to reoffer since they are down low and dirty. They initially offered the $10,000 deductible which irked the victims formerly known as clients. (November 14, 2013)

14. Exempting unions from reinsurance fee: The O-dirty-no-good-BLEEP administration gave their union lovers an exemption from the reinsurance fee which is one of ObamaCare’s many new taxes. To make up for this exemption, non-exempt plans will have to pay a higher fee, which will likely be passed onto consumers in the form of higher premiums and deductibles. (December 2, 2013)

15. Extending Preexisting Condition Insurance Plan: The OBLEEP administration extended the federal high risk pool until January 31, 2014 and again until March 15, 2014 to prevent a coverage gap for the most vulnerable. The plans were scheduled to expire on December 31, but were extended because it has been impossible for some to sign up for new coverage on healthcare.gov which is a multi-million-dollar boondoggle by a Canadian firm reaping enormous profits of a probable 600%(December 12, 2013) (January 14, 2014)

16. Expanding hardship waiver to those with canceled plans: The administration expanded the hardship waiver, which excludes people from the individual mandate and allows some to purchase catastrophic health insurance, to people who have had their plans canceled because of ObamaCare regulations. The administration later extended this waiver until October 1, 2016. (December 19, 2013) (March 5, 2014) ADVICE HAS BEEN..."Tell them you have HARDSHIP and don't say what or why and they will SPARE YOU the penalty." Everybody on Earth has SOME kind of "hardship" so that is NO LIE. Most people's hardship is at the very least...not qualifying to run the FOUR MINUTE MILE. Got HARDSHIP?

17. Equal employer coverage delayed: Tax officials will not be enforcing in 2014 the mandate requiring employers to offer equal coverage to all their employees. This provision of the law was supposed to go into effect in 2010, but IRS officials have “yet to issue regulations for employers to follow.” (January 18, 2013) The IRS has problems, they have HARDSHIP just giving 317,000,000 Americans HARDSHIP and wasting MILLION$ on FRAUD refunds NOBODY has the GUTS to call them on. Are they CROOKS are incompetent? Many are BOTH and many IRS owe back taxes the US government will NEVER SEE.

18. Employer-mandate delayed again: The administration delayed for an additional year provisions of the employer mandate, postponing enforcement of the requirement for medium-size employers until 2016 and relaxing some requirements for larger employers. Businesses with 100 or more employees must offer coverage to 70% of their full-time employees in 2015 and 95% in 2016 and beyond. (February 10, 2014) All American BUSINESSES COULD and SHOULD divide themselves into groups of 49 to avoid and evade onerous acts of Congress and the Obama Administration. Just register Widgetco 01, Widgetco 02, Widgetco 03, etc at the nearest courthouse until all 400,000 employees are in small companies. YOU ARE WELCOME! Most courthouses charge $5 or less for business registration/name changes.

19. Extending subsidies to non-exchange plans: The administration released a bulletin through

Centers for Medicare and Medicaid Services -AKA

CMS extending subsidies to individuals who purchased health insurance plans outside of the federal or state exchanges. The bulletin also requires retroactive coverage and subsidies for individuals from the date they applied on the marketplace rather than the date they actually enrolled in a plan. (February 27, 2014) The CMS is the newly named federal agency, formerly the Health Care Financing Administration, that administers the Medicare, Medicaid and Child Health Insurance programs.

20. Non-compliant health plans get two year extension: The administration pushed back the deadline by two years that requires health insurers to cancel plans that are not compliant with ObamaCare’s mandates. These “illegal” plans may now be offered until 2017. This extension will prevent a wave cancellation notices from going out before the 2014 midterm elections. (March 5, 2014) Most insurers just cut through all that red tape and changed their coverage OVERNIGHT to $10,000 deductible and an expensive premium as if the insured was DYING NEXT YEAR. Will working Americans be INSURED TO DEATH WITH CHARGES as WELL AS TAXED TO DEATH?

21. Delaying the sign-up deadline: The administration delayed until mid-April the March 31 deadline to sign up for insurance. Applicants simply need to check a box on their application to qualify for this extended sign-up period. (March 26, 2014) Some wealthy people MAY prefer to give up their citizenship and live offshore...rather than pay all this money for plans that are almost worthless.

22. Canceling Medicare Advantage cuts: The administration canceled scheduled cuts to Medicare Advantage. The Affordable Care Act (ACA) calls for $200 billion in cuts to Medicare Advantage over 10 years. (April 7, 2014) Jesse Jackson said he wanted CUTS to Obama's testicle bag when he was angry with the "Messiah" but Jackson gives not a rip what happens to America or Americans. He's one of THEM.

23. More Funds for Insurer Bailout: The administration said it will supplement risk corridor payments to health insurance plans with “other sources of funding” if the higher risk profile of enrollees means the plans would lose money. (May 16, 2014) WOULD and DO lose are two entirely different things. ONE grabs the risk BEFORE THEY LOSE but the latter reimburses them SHOULD they have big payouts making them LOSE. With the FORMER, the insurer HAS NO RISK because the gov't hammock COVERS the HIGH risk while they reap all the profits.

24. Exempting U.S. territories: Despite earlier administration claims that “HHS is not authorized to choose which provisions [of the ACA] might apply to the territories,” Healthy Human Sacrifices or Health and Human Services HHS waived six major requirements – such as guaranteed issue, community rating, and essential benefit mandates – that were causing serious disruption to health insurance markets. (July 18, 2014)AH...Moving or retiring to GUAM might be NICE after all!

CHANGES BY CONGRESS, SIGNED BY PRESIDENT OBAMA:

25. Military benefits: Congress clarified that plans provided by TRICARE, the military’s health-insurance program, constitutes minimal essential health-care coverage as required by the ACA; its benefits and plans would NOT normally meet ACA requirements. (April 26, 2010) This gives the distinct impression that the government likes to BLEEP the military any which way it can.

26. VA benefits: Congress also clarified that health care provided by the Department of Veterans Affairs constitutes minimum essential health-care coverage as required by the ACA. (May 27, 2010)

The HELL it does...scandals since JUNE 2014 and before prevail and tell a different story.

27. Drug-price clarification: Congress modified the definition of average manufacturer price (AMP) to include inhalation, infusion, implanted, or injectable drugs that are not generally dispensed through a retail pharmacy. (August 10, 2010) This SOUNDS like car dealers' "Manufacturers Suggested Retail Price" which is always too high.

28. Doc-fix tax: Congress modified the amount of premium tax credits that individuals would have to repay if they are over-allotted, an action designed to help offset the costs of the postponement of cuts in Medicare physician payments called for in the ACA. (December 15, 2010) This SOUNDS like that EXAMPLE double knee and hip replacements costing $100,000 but only covered $20,000 by gov't leaves individual getting 4 operations holding bag for $80,000. Will the gov't buy a round-trip TICKET TO INDIA where the left over from $20,000 MIGHT cover everything?

29. Extending the adoption credit: Congress extended the nonrefundable adoption tax credit, which happened to be included in the ACA, through tax year 2012. (December 17, 2010) WTF is this? If adopting a kid, the ACA is FREE? But if the "nonrefundable adoption tax credit" exceeds income...THEY keep the difference as "nonrefundable adoption tax credit"?

30. TRICARE for adult children: Congress extended TRICARE coverage to dependent adult children up to age 26 when it had previously only covered those up to the age of 21 — though beneficiaries still have to pay premiums for them. (January 7, 2011)What if they age beyond 26? Will Medicare take them in?

31. 1099 repealed: Congress repealed the paperwork (“1099”) mandate that would have required businesses to report to the IRS all of their transactions with vendors totaling $600 or more in a year. (April 14, 2011) This was CRAZY..totally lunatic...WHO dreamed THIS up? These guys would bury a live deaf mute in a burlap bag with seventy live starved squirrels!

32. No free-choice vouchers: Congress repealed a program, supported by Senator Ron Wyden (D., Ore.) that would have allowed “free-choice vouchers,” that the Hill warned “could lead young, healthy workers to opt out” of their employer plans, “driving up costs for everybody else.” The same law barred additional funds for the IRS to hire new agents to enforce the health-care law. (April 15, 2011) Enter the "Healthy Human Sacrifices" (HHS) and the EXTRA agents will enforce with the IRON GLOVE TREATMENT.

33. No Medicaid for well-to-do seniors: Congress saved taxpayers $13 billion by changing how the eligibility for certain programs is calculated under Obamacare. Without the change, a couple earning as much as much as $64,000 would still have been able to qualify for Medicaid. (November 21, 2011)

Ah HA! Added to Al Gore's "You are a MILLIONAIRE if you rake in $250,000 for four years BOVINE FECES is $64,000 for two equals WEALTHY. NOT if their expenses and college tuition for four children equals $65,000! They would steadily go in debt $1000 per year not even counting taxes.

34. CO-OPs, IPAB, IRS defunded: Congress made further cuts to agencies implementing Obamacare. It trimmed another $400 million off the CO-OP program, cut another $305 million from the IRS to hamper its ability to enforce the law’s tax hikes and mandates, and rescinded $10 million in funding for the controversial Independent Payment Advisory Board. (December 23, 2011)

The Co-Op earnings do not get counted as student income in the federal aid formula when students complete the Free Application for Federal Student Aid (FAFSA). Chaos is King and confusion supreme...WHAT are CO-OPs, IPAB? Private industry has Co-Ops paying big money or 0.00 so this MUST be some federal program for VUNNABLES with privileged character status and affirmative hiring,etc.

35. Slush-fund savings: Congress slashed another $11.6 billion from the Prevention and Public Health slush fund and $2.5 billion from Obamacare’s “Louisiana Purchase.” (February 22, 2012) Prevention and Public Health slush fund sounds like CORRUPTION and Obamacare’s “Louisiana Purchase.”was CORRUPTION and Sen. Mary (Marie Lavoe) Landrieu will not lik dat atall! NOT one BIT! She MIGHT HEX Congress!

36. Less cash for Louisiana: One of the tricks used to get Obamacare through the Senate was the special “Louisiana Purchase” deal for the state’s Democratic senator, Mary Landrieu. Congress saved another $670 million by rescinding additional funds from this bargain. (July 6, 2012) Sen. Mary (Marie Lavoe) Landrieu will not lik dat atall! NOT one BIT! She MIGHT HEX Congress!

37. CLASS Act eliminated: Congress repealed the unsustainable CLASS (Community Living Assistance Services and Supports) program of government-subsidized long-term-care insurance, which even the Democratic chairman of the Senate Finance Committee dubbed a “Ponzi scheme of the first order.” (January 2, 2013)

38. Cutting CO-OPs: Congress cut $2.2 billion from the “Consumer Operated and Oriented Plan” (CO-OP), which some saw as a stealth public option, blocking creation of government-subsidized co-op insurance programs in about half the states. Early reports showed many co-ops, which had received federal loans, had run into serious financial trouble. (January 2, 2013) Oh DAT Co-Op! We thought it was help for college students...SHOULD HAVE KNOWN BETTER. They are TREATED on a PAR like military. We lend BUT you must be a doctor in Alaska! No big income site for YOU, doctor.

39. Trimming the Medicare trust-fund transfer: Congress rescinded $200 million of the $500 million scheduled to be taken from the Medicare Part A and Part B trust funds and sent to the Community-Based Care Transition Program established and funded by the ACA. (March 26, 2013) WASSAT? More monkey-business is the Community-Based Care Transition Program?

40. Eliminating caps on deductibles for small group plans: Congress eliminated the cap on deductibles for small group plans as part of the Sustainable Growth Rate (SGR) “doc fix.” This change gives small businesses the freedom to offer high deductible plans that may be paired with a Health Savings Account. (April 1, 2014) WOW...people can pay too much for high deductable plan like $10,000 deductible THEN put the dimes and nickels in a Health Savings Account probably at 0.0002% interest to build up to $40 or $50 in only a few years for medical emergencies...like a cotton ball stuck in ONE ear.

CHANGES BY THE SUPREME COURT:

41. Medicare expansion made voluntary: The court ruled it had to be voluntary, rather than mandatory, for states to expand Medicaid eligibility to people with incomes up to 138 percent of the federal poverty level, by ruling that the federal government could not halt funds for existing state Medicaid programs if they chose not to expand the program. States OFF the HOOK!

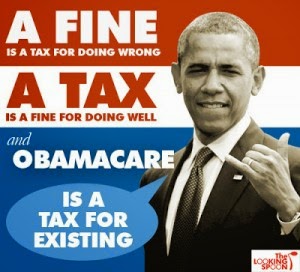

42. The individual mandate made a tax: The court determined that violating the mandate that Americans must purchase government-approved health insurance would only result in individuals’ paying a “tax,” making it, legally speaking, optional for people to comply.Individual folded, spindled and ON THE HOOK to be ROOKED...high prices for minimum care and prevention medical. Nothing left for care outside the "plan" out-of-pocket.

Will the GOP run its usual certain loser in 2016? Will the Democrats skim a scummy lawyer off a pond for a certain continuation of the misery inflicted by Obama? Stay TUNED for the NEXT THRILLING EPISODE of "WILL "THEY" GET YOUR GOAT? Or will "THEY" have you praying for DEATH like Biblical sufferer Job with all the bad luck and 400 BOILS COVERING HIS SKIN representing Obamacare 1400 BC?